One of USA’s Leading Marketplace Lender and Alternative Investing Platforms

Lend to USA’s and earn interest

98% of goPeer investors have earned positive net returns.

Open your free account to explore the platform, no investment required.

What are the risks?

2.7% loan loss rate across our loans

How it works

Allymon connects Canadians looking for a loan with Canadians looking to invest.

As an Allymon investor, you have the option to invest in Canadian consumer loans and also securities and companies, earn interest and monthly passive income with a great return on your investment(R.O.I).

With our investing approach, Allymon be focused on four broad verticals, sports, sustainability, health, and green energy companies. Then underneath those four verticals, I’m looking at it as four-sub verticals that we will be able to delve into. The first is sports performance, so that can be anything like a wearable device or anything that really helps an athlete’s performance. It could be in data analytics, anything involving AI, of course — the buzzword as of now.

The second area is health and medical so really anything on the health technology side involving medical, tech, even biotech. The third area we want to look at is fan engagement so more on the sports side again. It could be in stadium solutions, or TV, media-type solutions, really trying to engage with the next generation of sports fans.

And the fourth area will be wellness and lifestyle. Longevity is a huge play in that sector — anything that can obviously help extend the life but look at different ways to improve the quality of living as you get older. Wellness can also mean mental health. And nutrition is a big one that we’ll be looking at underneath wellness and lifestyle.

The Allymon Platform

The Allymon Platform

Browse through the platform and select the loans that match your investment objectives.

Perform Due Diligence

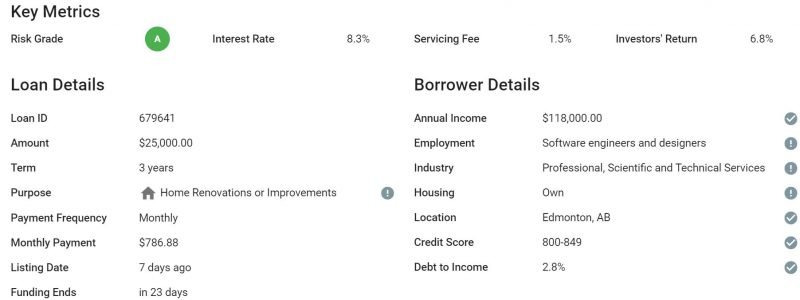

Each investment note provides borrower details such as their annual income, credit score range, debt-to-income ratio, and more.

How does Allymon make money?

How does Allymon make money?

How we mitigate risk

Rigorous credit

Diversification

Loan Servicing

American’s leading peer to peer lending platform

Allymon is American’s leading P2P lending platform dedicated to helping everyday Americans to lend and borrow from each other. Our innovative approach to lending focuses on financial wellness, empowering Canadians to help each other achieve their goals faster. We are able to offer better rates to borrowers than traditional lenders while allowing everyday Canadian investors to access a new passive income asset class.

Disclaimer:This information should not be construed as legal, tax, investment, financial, or accounting advice. The information may contain various forward-looking statements, which are statements that are not historical facts and that reflect Allymon’s beliefs and expectations with respect to future events and financial and operational performance. These forward-looking statements involve known and unknown risks, uncertainties, assumptions, estimates and other factors, which may be beyond the control of Allymon and which may cause actual results or performance to differ materially from those expressed or implied from such forward-looking statements. Nothing contained within the information is or should be relied upon as a warranty, promise, or representation, express or implied, as to the future performance of any loans. Investments available through Allymon are not bank deposits (and thus is not insured by the CDIC or other federal governmental agency), are not guaranteed, and may lose value. Investors must be able to afford the loss of their entire investment. This website provides preliminary and general information about the notes available on Allymon and is intended for initial reference purposes only.

Please note:*Past performance is not a guide to future returns, and your capital is at risk when investing through Allymon. As you are investing to your own individual portfolio of loans, your actual return and the actual bad debt you experience may be higher or lower than projected net returns. Please reach out to a Dealing Representative registered with Peer Securities Corporation (operating as goPeer) if you have any questions.